Car Road Tax Rates Explained

Updated for 2024/25 financial year | Originally Published 4 July 2022

This article will cover:

- what is car road tax?

- how is car road tax calculated?

- road tax for cars registered on or after 1 April 2017

- road tax for cars registered between 1 March 2001 and 31 March 2017

- road tax for cars registered before 1 March 2001

- vehicles exempt from road tax

- who is responsible for taxing a leased vehicle?

- how to check if a vehicle is taxed

What is Car Road Tax?

Vehicle Excise Duty (VED), more commonly known as car tax or road tax is an annual tax paid by anyone with a motor vehicle used on UK roads. There are different rates of car tax known as car tax bands, road tax bands or VED bands. Generally, the more CO2 your car emits, the more you pay.

Every year, on the 1st April the vehicle excise duty (VED), increases with inflation.

Road tax is enforced by the DVLA, and drivers who fail to pay could receive a fine of up to £1,000.

How is Car Road Tax Calculated?

Currently, the Vehicle Excise Duty (VED) system is split into two parts:

- First-year rate – A one-off rate charged in the car’s first year. This is typically included in the car’s on-the-road (OTR) price.

- Standard rate – A flat annual rate charged from the second year onwards.

The road tax rate you will be charged in the first year and subsequent standard rate years depends on several factors.

Factors That Impact Road Tax:

year of registration

The rate of road tax you will pay varies depending on when the car was registered.

Currently, the UK Government has three tiers:

- Cars registered on or after 1 April 2017.

- Cars registered between 1 March 2001 and 31 March 2017

- Cars registered before 1 March 2001

engine size

Cars registered before 1 March 2001 are charged based on engine size. Cars with an engine over 1549cc are charged at a higher annual rate than those with a smaller engine.

fuel type

For cars registered between 1 March 2001 and 31 March 2017, the vehicle tax rate is based on fuel type and CO2 emissions. The fuel type of the vehicle also affects new cars as alternatively fuelled vehicles, including hybrids, bioethanol and liquid petroleum gas, get a reduction to the Standard rate.

CO2 emissions

You’ll pay a rate based on a vehicle’s CO2 emissions the first time it’s registered. Cars with zero emissions pay nothing in their first year and a flat rate following that. High emission vehicles will pay a much higher rate. Find your car’s emissions.

value of the vehicle

For cars purchased after 1 April 2017 that cost more than £40,000, there is also an additional premium rate tax on top of the standard rate.

Road Tax For Cars Registered On Or After 1 April 2017

- You need to pay tax when the vehicle is first registered, this covers the vehicle for 12 months.

- You’ll then pay vehicle tax every 6 or 12 months at a different rate.

1. First Tax Payment When You Register The Vehicle

You’ll pay a rate based on a vehicle’s CO2 emissions the first time it’s registered.

You have to pay a higher rate for diesel cars that do not meet the Real Driving Emissions 2 (RDE2) standard for nitrogen oxide emissions. You can ask your car’s manufacturer if your car meets the RDE2 standard.

First tax payment when you register the vehicle (rates correct for 2023/2024)

| CO2 emissions (g/km) | Diesel cars (TC49) that meet the RDE2 standard and petrol cars (TC48) |

All other diesel cars (TC49) | Alternative fuel cars (TC59) |

|---|---|---|---|

| 0 | £0 | £0 | £0 |

| 1 – 50 | £10 | £30 | £0 |

| 51 – 75 | £30 | £135 | £20 |

| 76 – 90 | £135 | £175 | £125 |

| 91 – 100 | £175 | £195 | £165 |

| 101 – 110 | £195 | £220 | £185 |

| 111 – 130 | £220 | £270 | £210 |

| 131 – 150 | £270 | £680 | £260 |

| 151 – 170 | £680 | £1,095 | £670 |

| 171 – 190 | £1095 | £1,650 | £1,085 |

| 191 – 225 | £1,650 | £2,340 | £1,640 |

| 226 – 255 | £2,340 | £2,745 | £2,330 |

| Over 255 | £2,745 | £2,745 | £2,735 |

This payment covers your vehicle for 12 months.

2. Second Tax Payment Onwards

Your VED rate will change from your second annual payment onwards.

Annual Rates for Second Tax Payment Onwards (rates correct for 2023/2024)

| Fuel type | Single 12 month payment |

|---|---|

| Petrol or diesel | £190 |

| Electric | £0 |

| Alternative | £180 |

(Alternative fuel vehicles include liquid petroleum gas, hybrids and bioethanol powered)

3.Additional Premium Tax Rate for Vehicles With A List Price of £40,000 Or More

If your car or motorhome has a ‘list price’ exceeding £40,000 (published price prior to discounts), you’ll be required to pay an additional £410 annually. However, if you own a zero-emission vehicle, you are exempt from this charge. It’s important to note that this rate is only applicable for five years, beginning from the second taxation of the vehicle.

Road Tax For Cars Registered between 1 March 2001 and 31 March 2017

Drivers of older cars registered between 1 March 2001 and 31 March 2017 will continue to pay annual road tax based on fuel type and CO2 emissions, but with a slight increase due to inflation.

(rates correct for 2023/2024)

| Band | CO2 emission (g/km) | Petrol car (TC48) and diesel car (TC49)

(Single 12 month payment) |

Alternative fuel cars (TC59)

(Single 12 month payment) |

|---|---|---|---|

| A | Up to 100 | £0 | £0 |

| B | 101 – 110 | £20 | £10 |

| C | 111 – 120 | £35 | £25 |

| D | 121 – 130 | £160 | £150 |

| E | 131 – 140 | £190 | £180 |

| F | 141 – 150 | £210 | £200 |

| G | 151 – 165 | £255 | £245 |

| H | 166 – 175 | £305 | £295 |

| I | 176 – 185 | £335 | £325 |

| J | 186 – 200 | £385 | £375 |

| K | 201 – 225 | £415 | £405 |

| L | 226 – 255 | £710 | £700 |

| M | Over 255 | £735 | £725 |

Road Tax For Cars Registered Before 1 March 2001

The rate of vehicle tax is based on engine size.

| Private or light goods (TC11) Engine size (cc) |

Single 12 month payment |

|---|---|

| 1549 and below | £210 |

| Above 1549 | £345 |

Vehicles Exempt From Road Tax

Some types of vehicle are ‘exempt’ from vehicle tax. Do not be confused by the term exempt – it means you still have to tax your vehicle, but that it does not cost you anything.

historic vehicles

Vehicles made before 1 January 1982 are exempt.

electric vehicles

The electricity must come from an external source or an electric storage battery not connected to any source of power when the vehicle is moving to be exempt.

Hybrid electric vehicles are not exempt.

From 1 April 2025, electric cars will lose their VED exemption. Owners will pay the lowest first year rate of VED, which is currently set at £10 per year.

vehicles used by a disabled person

You can claim disability exemption when you apply for vehicle tax.

disabled passenger vehicles

Vehicles (apart from ambulances) used by organisations providing transport for disabled people are exempt.

Who Is Responsible For Taxing A Leased Vehicle?

If you currently lease your vehicle on a contract hire or personal contract hire agreement, the finance provider is responsible for providing the vehicle tax for the duration of the agreement.

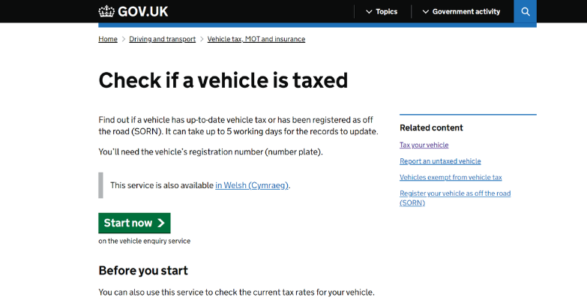

How To Check If A Car Is Taxed

There is a government website that allows you to check the vehicle tax on a car just by typing in the registration. See our simple guide on using this tax checker.

Back to all help and advice articles