What is a Credit Score?

7 April 2021

Your credit score is the 3-digit number that indicates how reliable you are at borrowing and repaying money, and how likely you are to be accepted for credit.

Your credit score is based on your credit report, (also known as your credit file) which is a record of how you’ve handled credit in the past.

Credit is when you borrow money with the agreement that you will pay it back later. There are many forms of credit including; credit cards, store cards, personal loans, paying for something in monthly instalments (e.g. a new car or sofa), some utility bills, overdrafts, mortgages & mobile phone contracts.

How does a credit score work?

Credit reference agencies compile information about your financial history into a credit report and use it to generate a credit score.

Lenders look at your credit score and credit report before coming up with a credit rating, which is used when deciding whether to accept your credit application, such as a credit card, loan, mortgage or service. It may also help them decide how much to offer you.

Lenders have their own mathematical system for creating a credit rating, which is used to judge how likely it is for individuals or businesses to be given credit.

People with a higher score are often seen as lower risk, which means lenders are more likely to give them credit.

Who are the credit reference agencies?

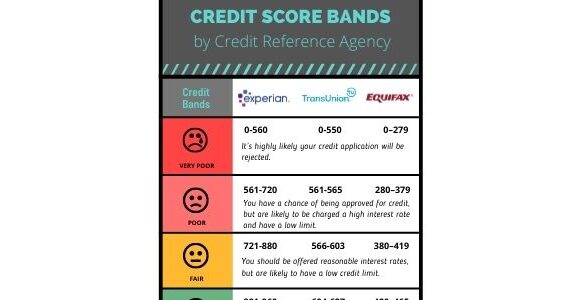

There are three credit agencies which hold credit reports on you: Equifax, Experian and TransUnion (formerly Callcredit). They don’t make lending decisions and lenders don’t tell them how the information they provided has affected a decision.

A credit report won’t tell you for certain whether you’ll succeed in a credit application, but it’s worth checking yours doesn’t include any incorrect information.

Having no credit history makes it hard to get a credit score

Credit scoring is about predicting if you’re likely to pay back credit based on how you’ve handled it in the past. So, if you have never borrowed money before or only borrowed a little, it will make it more difficult for lenders to judge whether you will be a high or low risk person to lend to. So, as a default, they’re likely to assume you are a high risk. This might mean you’re only offered credit at a higher rate of interested, or not accepted for credit at all.

Why do credit scores matter?

Your credit score can determine whether you get accepted for a loan or credit card and impacts the type of deal you might be offered.

If you have poor credit, you may find you’re offered a higher interest rate. It can also affect other types of credit agreements, such as mobile phone plans.

A good score can help you get approved for credit cards, loans and mortgages, while a bad score can stop you getting approved.

What affects your credit score?

Your credit score is a reflection of the way you’ve managed your debts and bills in the past. So if you’ve borrowed money in the past and always kept up with repayments, this will have had a positive impact on your score. But a history of missing or making late payments would have had a negative impact.

Your credit score is based on your credit report which includes

- all your credit agreements such as loans and credit cards, including any held jointly with other people

- your history of credit repayment, including payments you’ve missed over the last six years

- public records, including County Court Judgments and the electoral roll

Factors that have the biggest negative impact on your score are:

- Repeatedly missing or making late payments

- Defaults on debt

- County Court Judgments (CCJs)

- Bankruptcy

Compass Vehicle Services Ltd offer:

nationwide car leasing – bad credit car finance – used car deals – personal leasing – business car leasing – best car lease deals – non-status car leasing

Back to all help and advice articles