What Does It Mean To Have No Credit?

Published 21 April 2022

Having no credit score means that you’ve never opened a credit account, such as a loan or credit card. This situation is often referred to as having a “thin file” in the credit world. Essentially, there isn’t enough financial data on you for credit agencies to generate a score.

Who Typically Has No Credit?

Young adults and new businesses often find themselves without a credit score simply because they haven’t had the opportunity or need to establish credit in their name. If you’ve never taken out a loan or opened a credit card, you won’t have a credit history—and without a history, there’s no score.

Why Does Having No Credit Matter?

When you lack a credit history, you may face difficulties when trying to access financial products like mortgages, loans, credit cards, or even mobile phone contracts. These institutions rely on credit scores to assess the risk of lending to you. Without a credit score, they have no track record to review, which can make them hesitant to extend credit.

No Credit vs. Bad Credit: What’s the Difference?

It’s important to differentiate between having no credit and having bad credit:

- No Credit: If you have no credit, it means there’s no record of your credit activities. Creditors have no way to predict how you might handle credit since you’ve never used it.

- Bad Credit: On the other hand, bad credit means you have a credit history, but it includes negative marks—such as late payments, defaults, or bankruptcies—that lower your credit score.

Is It Worse to Have No Credit or Bad Credit?

Neither situation is ideal, but they are different. Having no credit can be a challenge because creditors lack information to evaluate your creditworthiness. However, having bad credit is typically worse, as it indicates a history of financial mismanagement, which can make lenders view you as a higher risk.

Why You Might Not Have a Credit Score

There are a few reasons why you might not have a credit score:

- You Have No Credit History

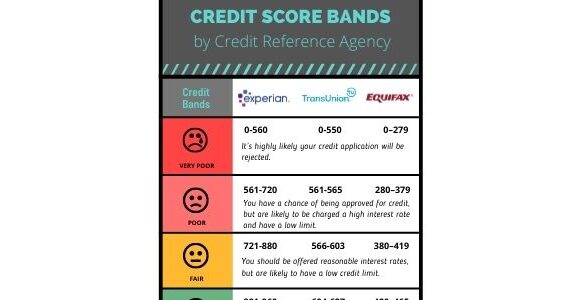

Your credit history begins when a lender or credit provider reports your financial activity to one of the UK’s three main credit reference agencies—Experian, Equifax, or TransUnion. If you’ve never used credit in the UK, you won’t have a credit report or score.

Common reasons for having no credit history include:

- You’re new to the UK: Credit histories do not transfer between countries. If you’ve recently moved to the UK, it may take up to six months to build your first credit report and score.

- You’ve never had a credit account in your name: You might be young or simply haven’t needed to use credit. Even if you contribute to joint bills or have a mobile phone contract, if these accounts aren’t in your name, they won’t appear on your credit report.

- Your Credit History Is Too Old

When you close a credit account, it stays on your credit report for up to six years. After that, it’s removed. If you close all your credit accounts and don’t open any new ones, your credit score might eventually disappear altogether. This situation often occurs when people leave the UK to live in another country and cease using UK-based credit.

Conclusion

Having no credit isn’t the same as having bad credit, but both can pose challenges when trying to access financial products. Understanding why you might not have a credit score is the first step toward building or rebuilding your credit history.

Back to all help and advice articles